This Week In Cartoons Sept 30, 2022Sign Up forThe Morning NewsletterWe can’t do an episode of THEORIES BY A MINUTE without talking about the Dow dropping over 500 points this week as everyone is getting rattled by the former President Donald Trump’s comments, including some of our most staid investors. How many more of these little things can we take? Nvidia and Tesla were among the tech giants that were specifically hit hard, with their stocks taking losses in the sell-off. This sharp decline has raised alarm bells, which has drawn fears of the future trend in the market; analysts are trying to analyze how this will impact investor behavior and the economy as a whole.

Trump’s Remarks Send Markets Into Turmoil

His remarks, which covered topics from his economic policies to his continued hold over the political landscape, sent shock waves of uncertainty through financial markets. His unpredictable, often incendiary comments have always roiled volatility and this latest was no different.

The former president’s comments came against a backdrop of continued political volatility and fears over the U.S. economy’s recovery from the pandemic. Investors were already jittery over inflation, rising interest rates, and geopolitical uncertainty, and Trump’s comments intensified those fears.

In Dow Jones Futures: Immediate Reaction

Dow Jones futures plunged more than 500 points soon after Trump’s remarks. It was a controversial step, sending ripples of concern around Wall Street and sparking worries that the market could correct itself. The index, widely viewed as a marker for the wider U.S. economy, slipped in early morning trading as the market responded to the increased uncertainty.

Investors, especially in the tech industry, responded instantly to the news as sell-offs flooded major stocks. The tech-heavy Nasdaq also tumbled, evidence of increasing jitters among traders.

Nvidia Down Amidst Market Wobble

Nvidia, a top semiconductor company, was one of the stocks most affected after Trump’s comments. The company’s shares, which have enjoyed a boost from the global boom in demand for semiconductors, fell by more than 3 percent in early trading.

Nvidia’s shares had surged for months, riding strong growth in its gaming business and its burgeoning role in artificial intelligence and data centers. But market turbulence, stoked by political commentary, has curbed its momentum. Nvidia, like many tech companies, has been affected by overall economic conditions, including supply chain problems and regulatory worries.

The Consequences for Nvidia’s Long-Term Prospects

While Nvidia’s stock price took a hit immediately, experts say the company’s long-term potential looks bright. The company remains at the forefront of the booming semiconductor space and has seen its offerings in high demand across industries, including gaming, AI, and self-driving cars.

However, if political instability keeps the pressure on the markets, Nvidia might continue to experience volatility in the near term. Investors will have to weigh the company’s potential upside with the headwinds that could affect its performance.

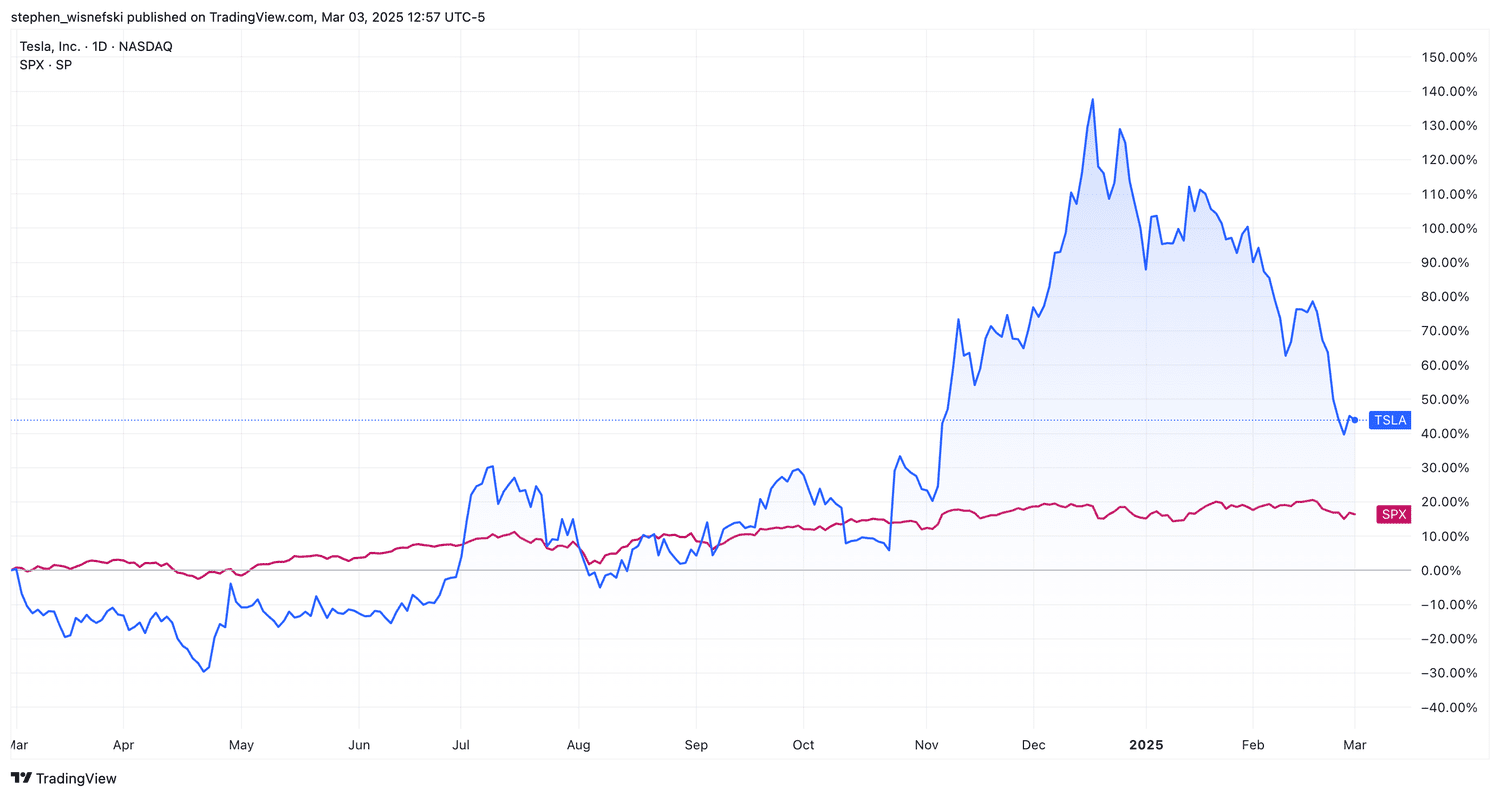

Tesla is on the Way Down as Investor Fears About Political Uncertainty Mount

Tesla, the world’s most valuable electric vehicle (EV) maker, also bore the brunt of the market’s response to Trump’s remarks. The shares dipped significantly, down more than 4 percent in early trading, as investors reset their expectations in the face of increasing feelings of market instability.

Tesla’s shares have been historically volatile, often responding aggressively to movements in the broader market as well as comments from its chief executive, Elon Musk. This time around, though, it was external political forces — including Trump’s comments — that led to such a significant loss of value for the stock.

Tesla Compared to The Rest of the EV Market

Tesla still leads in the EV sector with a large market share and increasingly large fleet of EVs. With the latest technology of autonomous driving and other versions of cars, empresa has made a lot of progress. But Tesla’s dominance in the electric vehicle space is facing a growing challenge from traditional automakers like Ford and General Motors, which have significantly increased their electric vehicle production.

In addition, fears of regulatory shifting and competition have caused investors to worry about Tesla’s ability to keep its lead in the field. These factors, along with the sway over market sentiment that Trump’s rhetoric has held, have contributed to the recent drop in Tesla’s stock price.

Why Investors Are Reacting So Aggressively

The stock market is a sensitive barometer for investor sentiment and public comments from figures like Trump can trigger wild decibel changes. Several factors are contributing to the plunge in Dow Jones futures and drop in tech shares such as Nvidia and Tesla:

Political Uncertainty

Trump’s remarks highlighted the persistent political uncertainty in the U.S. market. Political instability raises the prospect of shifts in policy, particularly regarding taxes, regulations, and trade. When investors believe that political risk is a threat to economic stability, they carpet bomb safer assets, as evidenced by the sell-off that followed Trump’s remarks.

Persistent Inflation and Economic Concerns

Besides political dangers, the overall economic climate has made a perfect storm for market fluctuations. Inflation in the U.S. has been going up and the Fed has been raising interest rates to try and fight it. Those actions have made it more expensive for businesses and consumers to borrow money, a move that could stifle economic growth. Political commentary has compounded the market’s nervousness about these economic forces.

The Role of Tech Stocks

And tech stocks, especially in sectors such as semiconductors and electric vehicles, are generally considered the market leaders. When these stocks fall, it can lead to a wider sell-off in the market. As industry bellwethers, Nvidia and Tesla are especially sensitive to sentiment changes, making them especially susceptible in bad-news environments.

Then, Make a Decision After a While Based on Expert Opinion on Current Market Conditions

Market experts are split on the long-run implications of the present market turmoil. Others think the sell-off is an overreaction and that the market will rebound once political noise dies down.

“Though Trump’s comments might’ve caused a dip in the short term, the fundamentals of the U.S. economy are sound,” said Mark Thompson, a senior economist at Hillcrest Capital. “It’s likely that the markets are going to stabilize once investors digest the news and recognize that the economic recovery is still intact.”

Others, though, are warning that the political backdrop could result in additional market turbulence in the months ahead. “Political risks are always something to consider, but when the likes of Trump make these strong statements, it creates a very large uncertainty,” said Sarah Collins, a market strategist at Global Investments. “Investors can expect additional volatility in the near term.”

This age has been crazy in present market.

For investors, maneuvering through this volatile market will be a careful balancing act. And while short-term fluctuations are to be expected, I believe you should remain focused on the enormous long-term potential of companies such as Nvidia and Tesla.

Diversification is Key

One of the most powerful mechanisms to reduce risk during any period of market uncertainty is diversification. Diversifying investments across expenditures, asset classes, and regions can help shield them from larger market downturns.

Focus on Fundamentals

Political commentary might create short-term volatility in the stock prices of some companies, but nothing changes the fundamentals of strong companies like Nvidia and Tesla. The daily ups and downs of the market should not be allowed to influence an investor’s buy/don’t buy decision on these companies.

Part 4: Conclusion: Dow Jones, Nvidia, and Tesla in the Future

Falling long like this in the Dow Jones futures, while Nvidia and Tesla stock prices dive, causing what some market experts call flooding — floodlit, flood sold, flood plunges — makes volatile sense that go well on the overall anymore October 2023. The immediate cause of the drop can be directly linked to Trump’s eloquent comments, but the underlying trepidation over inflation, political uncertainty, and the economy’s comeback underpins all of it.

For now, the market is jittery, and investors will have to stay alert. But with fundamentals supporting the growth of companies such as Nvidia and Tesla, the long-term outlook doesn’t have to be a worrying one, even if turbulence hammers the market short-term.

FAQs

1. What caused Dow Jones futures to drop 500 points?

Political jitters hand in hand with controversial remarks from former President Donald Trump sent Dow Jones futures tumbling 500 points.

2. What was the impact of Trump’s remarks on Nvidia and Tesla?

Trump’s comments added to a broader market sell-off that hit the stock prices of both Nvidia and Tesla hard as investors processed the political turmoil and turbulence in the markets.

3. Is it a good long-term investment?

Nvidia is a leader in the semiconductor industry and one of those financial growth stories despite short-term jitters from these trades, particularly in the Artificial Intelligence and gaming sectors. There are some short-term challenges to be faced due to market conditions and political uncertainty.

4. What does the future hold for Tesla?

Tesla (TSLA) remains at the forefront of the electric vehicle market, but it faces growing competition and regulatory scrutiny that could dent its stock ahead. Yet the company’s long-term outlook is intact.

5. How can investors shield themselves from volatile markets?

From a risk-mitigation approach, there’s a reason why investors intend to look beyond these sectors as well as identify solid basics companies. On the investment side, paying attention to economic and political developments can help you navigate your investments.